Customer Policy Benefit Summary Service Allianz Ayudhya

Information as of March 31, 2025

Do you know what’s included in your policy details?

What you should know and be cautious of if someone calls you offering to help review your policy:

If someone contacts you requesting to review your policy, Allianz Ayudhya would like to inform you that the company has no policy to request or review customer policy documents under any circumstances. Therefore, please do not disclose any personal policy information to such callers.

To help you better understand your own policy, we have prepared this guide so you can independently review and interpret your policy details.

What kind of information should you not miss in your policy document?

- Life insurance plan and the sum assured

- Health insurance plan and inpatient coverage amount

- Policy starts and end dates

- Policy status

- Policy values (e.g., cash surrender value)

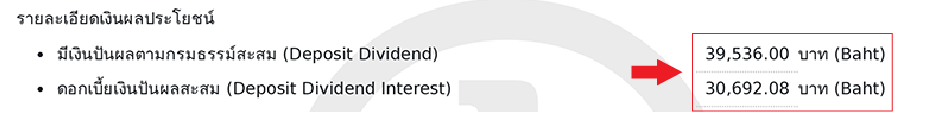

- Policy benefits, accumulated policy dividends, and interest on dividends

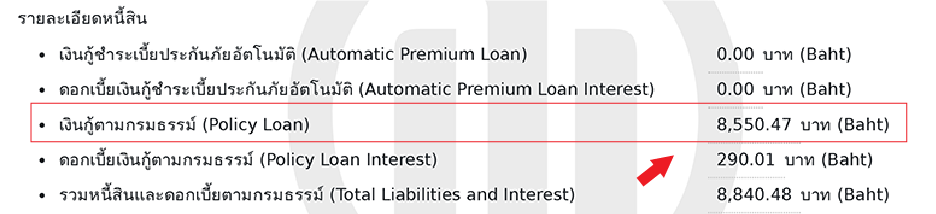

- Outstanding debts (if any), including automatic premium loans and policy loans

- Name and contact number of your assigned insurance agent

Understand Your Policy Details with the Example Below

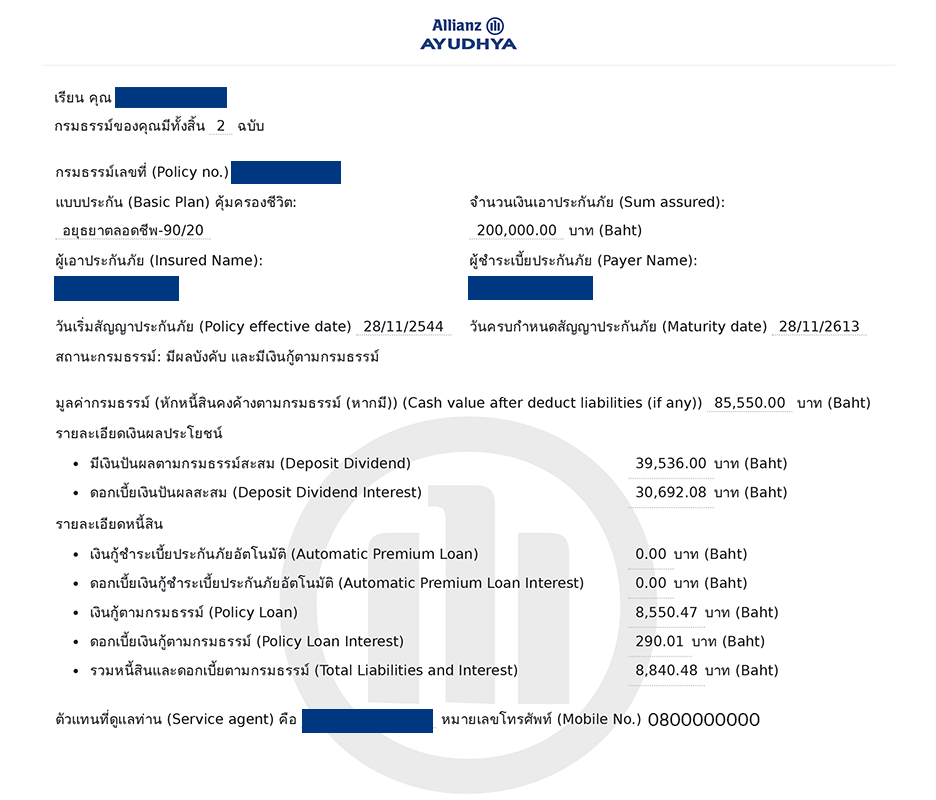

- Contract Start Date or the date when the insurance coverage becomes effective

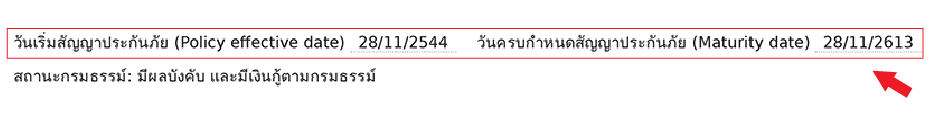

- Contract Expiry Date which may include the main contract and additional riders, depending on your policy and insurance plan

- Check your Health Insurance coverage carefully, especially the inpatient coverage amount.

- Note the start and end dates of your health insurance coverage because details vary from policy to policy.

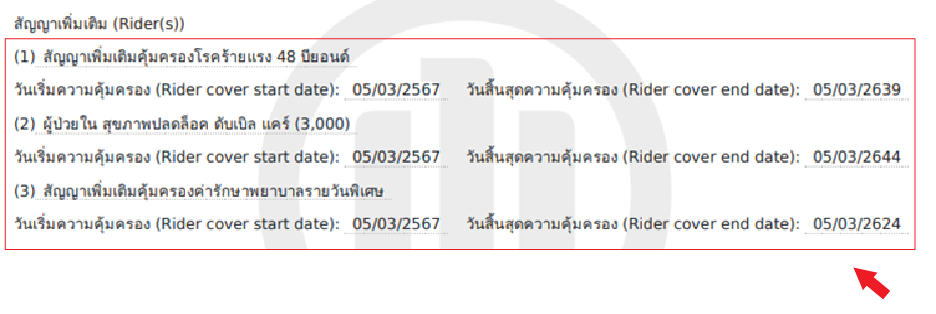

- Policy Value: This value accumulates each year based on the premiums you pay. It grows over the policy term (in the early years, your policy may not have any cash value yet).

Note: The cash value of your policy represents the total premiums you have paid so far. If you stop paying premiums and allow the policy to lapse, you risk losing all the premiums paid since the first year of your policy, resulting in reduced benefits.

- Policy Status as of March 31, 2025

This shows whether your policy is still active and providing coverage or other statuses. You can learn more from the sample details below.

Examples and Details of Policy Status

5.1 Policy Active – Your policy is still in force with coverage as specified.

5.2 Policy Active with Policy Loan - Your policy has a loan taken against the accumulated cash value. The maximum loan amount varies by company and insurance plan. (You can find more details on the My Allianz app or by calling 1373.)

For more info, visit: [Link:(99+)azayfan (@allianz_ayudhya) | TikTok)

5.3 Policy Active with Automatic Premium Loan - If you miss a premium payment within the grace period and your policy has sufficient cash value, the company will automatically loan against your policy’s cash value to pay your premium, ensuring continuous coverage. You can check your loan and interest details via the My Allianz app or contact 1373 to stop this loan.

More details: [Link:(99+)azayfan (@allianz_ayudhya) | TikTok)

5.4 Policy Active with Both Automatic Premium Loan and Policy Loan - Besides the automatic premium loan, you can also borrow additional loans against your policy. The loan amount depends on your policy’s cash value and varies by company and plan. The interest rates are generally lower than bank loans. Check loan limits and interest rates on the My Allianz app under “Loan Against Policy.”

5.5 Extended Term Policy - If you stop paying premiums for some time and your policy’s cash value isn’t enough to cover automatic premium loans, the policy coverage period will be reduced to maintain the same level of coverage, but only the main contract remains active; any additional riders end immediately. To restore the original coverage period, you may pay overdue premiums. Contact 1373 for assistance.

- For life insurance or savings-type policies that pay dividends, you can check your dividend value as of March 31, 2025.

Note: Dividends are profit shares paid to policyholders in addition to benefits stated in the policy. Dividends are not guaranteed and depend on the insurer’s performance each year.

You can change the method of receiving or withdrawing your dividends at: Click

- Your policy has a loan taken against the accumulated cash value within the policy. The maximum loan amount varies depending on the insurance company and your specific plan. The loan carries a lower interest rate compared to borrowing from a bank. You can repay the loan through the My Allianz application or by calling 1373.

For more details and to better understand this, please click here: (Link : (99+)azayfan (@allianz_ayudhya) | TikTok)

You can read the terms and conditions and the loan procedures according to the policy at Click